Tuesday, 4 September 2012

THEIR

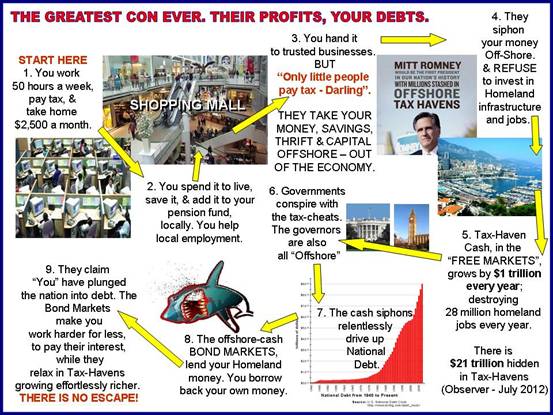

PROFITS – YOUR DEBTS – YES, WE ARE BEING CONNED.

This nine step cycle

shows why OECD governments are all claiming “There is no money; we are deep in

debt; there are mountains of debt; you must lose your jobs, homes and take

pay-cuts”. They parrot this mantra

despite the global economy having the most productive systems ever in human

history and, thanks to automation, creating more real-wealth than was dreamed

of even fifty years ago.

You know that you

keep working hard. You do your bit for the economy. You pay your bills and

taxes and pay into a pension fund. So, where does the ever increasing real-wealth

go?

Via the

international banks, the FREE MARKETS and the Internet – the bankers, lawyers

and accountants who we once trusted to keep our money safe have been fiddling

the books for themselves and big-business on a global scale. The paper-shufflers

have become corrupt. To protect their crooked dealings they recruit anyone who

might be a serious threat. They believe they can escape all taxes, gouge

capital from Homeland economies and laugh all the way to the funny-money-banks

in government approved tax-havens. They

corrupt IRS, HMRC, The Courts, media personnel, celebrities and elected

representatives to join the happy throngs of tax-free tapeworms, off-shore.

In 2009, The OECD Paris, estimated there was $18 trillion off-shore. In July

2012, The Observer newspaper (

It is a triple

assault on our economies. “They” not only do not pay tax on income, but we are

dumb enough to grant tax relief on sham invoices from potty little islands and

protected jurisdictions such as Delaware, where “they” pretend to have major

businesses. They are given tax-refunds at home AND they take all the capital

offshore. All that really exists are brass-plates, bent lawyers and dummy

directors. And THE LAW, the gravity and majesty of the law of our lands,

pompously accepts these pantomimes as being real businesses. They are fakes. They are false accounting.

They are fraudulent conspiracies.

Who are they? Most major companies now have dozens of sham

companies in tax-havens, just like ENRON had. Many wealthy families have sham

“Trusts” or “Charities” in tax-havens. High earning celebrities pretend to by

employed by companies in tax-havens. Doctors, dentists and plumbers have sham

companies in tax havens. All the pretended transactions, the paperwork, that

siphon money from the homeland to offshore are illegal. They have been illegal

for 100 years. Ask Al Capone; ask Arthur Andersen, ENRON’s

now banned auditors.

It is time this

nonsense stopped. The hidden money should all be assumed to be illicit in

tax-law, assessed and repatriated. The honest owners will not be penalised by

back-duty-tax investigations – but the majority breaks the rules and should be

repatriated. It is time to invest the $21 trillion back into Greece, Spain,

Italy, Japan, UK, USA and all OECD countries; so that we can move on into the

next phase of economic and human development. We must shake loose from the

paralysed, terrified “owners” of the offshore hoards, sitting on their hands

and stopping the healthy circulation of money – and put the $21 trillion back

to work.

Where are the World

Statesmen and Women brave enough to shout “The King has no clothes” and bring

an end to these disgraceful con-tricks. In the

meantime – the next idiot or complicit banker, economist or politician who

bleats “…but there’s no more money” - throw them into the local

pond.